Probate Seller

What is Probate?

Probate is the legal process that you must follow to transfer or inherit property after the person who owned the property has passed away. Depending on the amount and type of property the deceased person owned, you may or may not need to go to court to transfer or inherit the property. All of the property legally owned by the deceased person is called the person’s “estate”. If you need to go to court, this is commonly called “going through probate”. A person’s estate may need to go through probate even if they had a will.

If you find an original will, you must deliver it to the court. Delivering a will to the court is called “lodging the will”. You must also send a copy of the will to the executor named in the will. If you cannot find the executor, then send it to a person named in the will as a beneficiary.

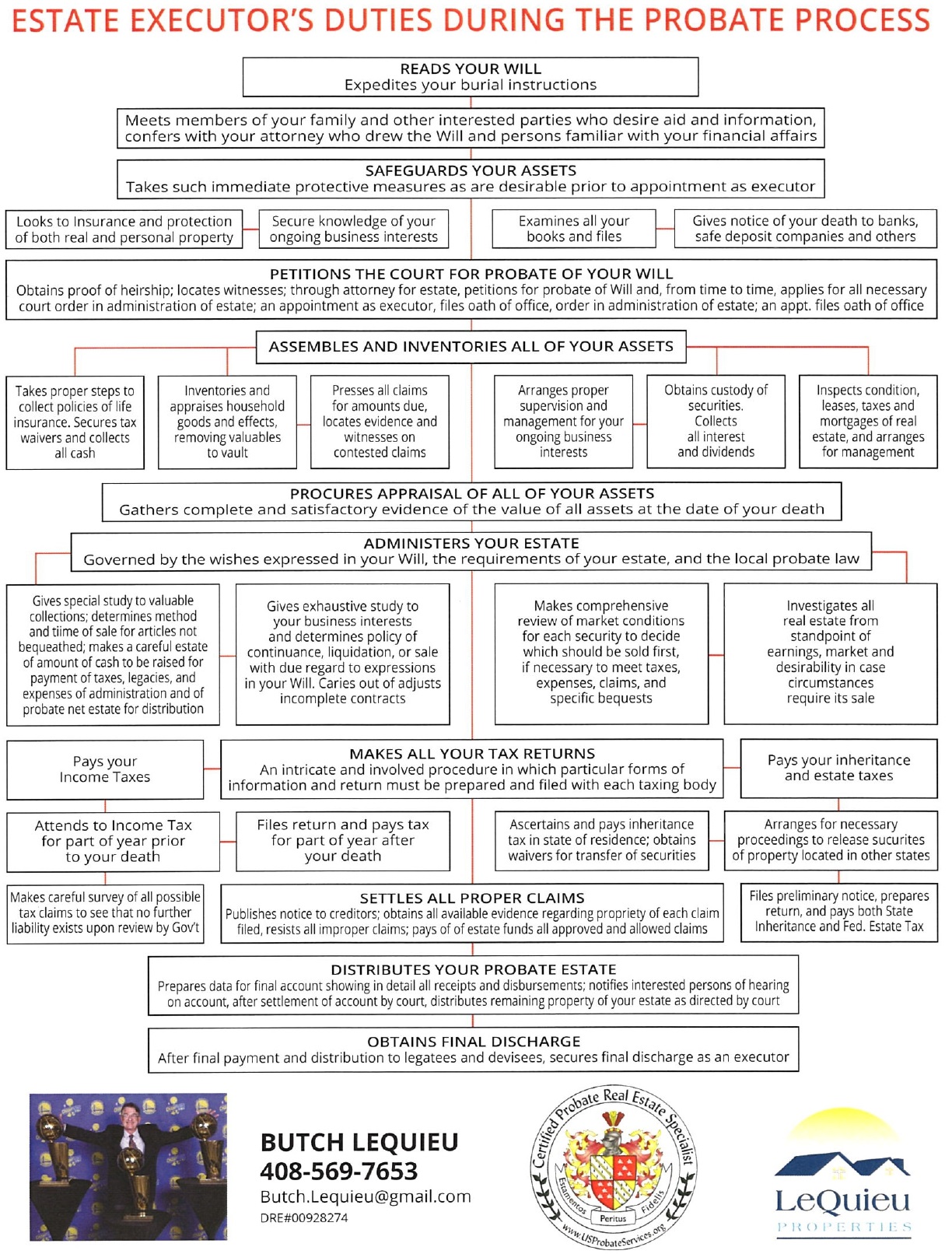

To start a probate case (called opening probate), you go to court and ask the judge to appoint a personal representative. The personal representative is the person responsible for representing the estate in the probate process. The personal representative collects all the property of the person that died, pays their bills, and then distributes any remaining property to the people with the legal right to receive the property (called heirs or beneficiaries).

The probate court also handles other types of cases, like when an adult that is not a child’s parent asks for custody of the child (called guardianship) or when an adult asks for the right to act or make decisions for another adult with a disability or impairment (called conservatorship)

Does the estate need to go through probate?

To inherit property from someone who has passed away, you will first need to figure out what process you can use to transfer the property. You make need to go to court, but in some cases, you do not. One of the first things to do is check who is the right person is to handle these matters.

Who is the right person to handle probate matters?

Typically, the person named in the will or a close relative if there is not a will handles the probate matters. Two or more people can represent an estate together. But they must always act together.

- If the person had a will or trust, the person listed as in charge (often called an executor) will generally handle any probate. If they cannot or do not want to, then it will often be a relative.

- If the person did not have a will or trust, often a close relative will handle any probate. If the person was married when they died, their spouse is often the person. Or, if they have adult children, then an adult child. Relatives should generally talk to each other to decide who and how decisions will be made for the estate.

- If the transfer of property needs to go through probate, a judge will appoint someone as a personal representative of the estate. The law preference (also called priority) to who this will be. This is often the person named in the will. If the person named in the will cannot act or there is no will, then there’s an order of priority for who may be appointed a personal representative. The order of priority is any surviving spouse or domestic partner, then a child, then a grandchild, then a parent, and then a sibling. A judge will need to decide which person has priority.

Probate Terms (Glossary)

Here are some important probate terms you’ll want to know:

- Beneficiary: A person who inherits when there is a Will

- Custodian of the Will: The person who has the Will when the person who wrote the Will dies

- Decedent (or deceased): The person who died

- Decedent’s estate: All the property (real or personal) that a person owned at the time of death.

- Executor: A person named in the Will and appointed by the Court to carry out the dead person’s wishes.

- Heir: A person who inherits when there is no Will

- Intestate: When someone dies without leaving a Will

- Intestate succession: The order of who inherits the property when someone dies without a Will

- Legatees or devisees: People who are named in the Will

- Personal property: Things like cash, stocks, jewelry, clothing, furniture, or cars.

- Personal representative (or administrator or executor): The person responsible for overseeing the distribution of the estate.

- Probate: The process of deciding where, how, and to whom to distribute the decedent’s property

- Real Property: Buildings and Land

- Testate: When someone dies leaving a Will

- Trust: When one person (Trustee) holds property at another person’s (settlor’s request for the benefit of someone else (the beneficiary).

- Will: A legal paper that lists a person’s wishes about what will happen to his/her property after death.

Need to Sell Real Property in Probate?

Butch LeQuieu, broker/owner of LeQuieu Properties has been trained by MTI Education and earned the designation of Certified Probate Real Estate Specialist. Butch is knowledgeable of all the details that must be performed to maximize the value of the estate and shows compassion and care when working with probate administrators, executors and heirs.

Services

- We will discuss with the family fiduciaries and their attorneys the estates requirements and then develop a strategy to maximize the resale value of property in the estate.

- We provide assistance with personal property distribution and estate liquidation which includes short term storage rental, dumpster services and estate sale liquidation services.

- We provide free property checks, lockbox services, and landscaping services.

- We have a team of painters, plumbers, electricians and general contractors that can make repairs to maximize the sales price.

- We work closely with the probate attorneys to keep them well informed during the escrow process.

- We work with the Title Company to make sure all probate documentation is provided in a timely manner.

- We use sophisticated transaction management software and provide detailed documentation to family fiduciaries and their attorneys though out the escrow.

How Much Does a Lawyer Charge to Probate a Will in California?

Probating a will in California can be a complex process, often requiring legal assistance to navigate the state’s specific rules and procedures. One of the most common questions asked by individuals involved in estate administration is: How much does a lawyer charge to probate a will? Here, we’ll break down the costs associated with probate in California, including attorney fees, so you can make informed decisions.

Attorney Fees for Probate in California

In California, attorney fees for probate cases are regulated by law. The state’s Probate Code sets a statutory fee schedule based on the gross value of the probate estate. This fee structure applies unless the attorney and the client agree to a different arrangement.

The statutory fees are calculated as follows:

- 4% of the first $100,000 of the estate’s gross value

- 3% of the next $100,000

- 2% of the next $800,000

- 1% of the next $9 million

- 0.5% of the next $15 million

- For estates above $25 million, fees are negotiated by the parties.

Example Calculation

Let’s assume an estate has a gross value of $500,000:

- 4% of the first $100,000 = $4,000

- 3% of the next $100,000 = $3,000

- 2% of the remaining $300,000 = $6,000

Total attorney fees on estimated probate value of $500,000: $13,000

Note that attorneys' fees are paid at the end of the Estate assets of the probate and are subject to Court approval. The Administrator does not have to pay these fees in advance and does not have to pay the fees from their own pocket.

It’s important to note that the gross value does not account for debts or expenses. For example, if the estate includes a home worth $500,000 but has a $400,000 mortgage, the attorney fees are still based on the $500,000 gross value.

Additional Costs to Consider

In addition to attorney fees, there are other expenses associated with probating a will in California that will be required regardless of whether you do it your or hire a lawyer:

1. Court Filing Fees: Typically, these range from $435 to $650, depending on the county.

2. Executor Fees: Executors are entitled to the same statutory fees as attorneys unless they choose to waive their compensation.

3. Appraisal Fees: A court-appointed probate referee appraises the estate’s assets, and their fee is typically 0.1% of the appraised value.

4. Miscellaneous Costs: These can include costs for publishing notice to creditors, obtaining certified copies of court documents, and mailing notices.

Can You Reduce the Costs of Probate?

Yes, there are ways to reduce probate costs, such as:

Using a Trust: Assets held in a living trust do not go through probate, saving time and money.

Small Estate Affidavit: For estates valued under $184,500 (as of 2025), you may avoid probate entirely by using a small estate affidavit.

Proper Estate Planning: A well-drafted will and proper estate planning can simplify the probate process and minimize fees.

Is Hiring a Lawyer Necessary?

While it’s not legally required to hire a lawyer to probate a will, having professional guidance can help avoid costly mistakes, especially in more complex cases. A lawyer can ensure compliance with California probate laws, meet court deadlines, and handle disputes among beneficiaries.

Conclusion

Probating a will in California involves various costs, with attorney fees being a significant component. By understanding the state’s statutory fee structure and exploring strategies to reduce costs, you can make the probate process more manageable. If you have questions about probate or need legal assistance, consult with an experienced California probate attorney to ensure the best outcome for your case.